Allianz Commercial

Barclays Proposal 2024

Introduction

Many thanks for the opportunity to meet with you again and to discuss our Allianz proposals on the Property and Casualty. The Allianz team are committed to support you across a number of areas detailed below, working alongside Marsh by delivering the best of Allianz to you.

Allianz Commercial has a reputation built upon technical underwriting ability, as well as claims, risk consulting and multinational client services. We understand the business of risk, and more importantly we understand your risk having a long standing relationship at various levels across a number of lines of business. We look forward to continuing to work with you and Marsh over the coming months and we would be delighted to address any questions you might have either today or in the future.

About Allianz

Allianz Group at a glance

- With around 150,000 employees worldwide, the Allianz Group serves over 100 mn customers in more than 70 countries.

- On the insurance side, Allianz is the market leader in the German market and has a strong international presence.

- In fiscal year 2023 the Allianz Group achieved total revenues of approximately €161.7bn.

- Allianz is one of the worlds largest asset managers, with third-party assets of €1.712tn under management at year end 2023.

Did you know?

Allianz is the Worldwide Insurance Partner of the Olympic & Paralympic Movements

We insure the Gotthard Base Tunnel – the world’s longest railway and deepest traffic tunnel running through the Swiss Alps.

We insure the Union of European Football Association (UEFA)

We insured the last three structures to hold the title of world’s tallest building: Petronas Towers, Taipei 101 and Burj Khalifa and insure Burj Al Arab

Allianz Results

AGCS SE remains one of the highest rated global Property & Casualty insurers.

stable outlook

(affirmed 06/2023)

stable outlook (upgraded 09/26/2023)

stable outlook (affirmed 03/204)

*Includes ratings for securities issued by Allianz Finance II B.V. and Allianz Finance Corporation.

Allianz Commercial

Allianz Commercial: A winning combination – bringing our best for businesses under one roof

- One commercial lead per region to represent the business, simplifying your experience.

- Clarity in our approach and offering will drive efficiency, time to market and execution speed.

- Commercial experts focused on trading, underwriting, and customer delivery bundling expertise.

- Simplified access through coordinated distribution, client management teams and empowered underwriting.

- Consistent global underwriting appetite and approach with market-leading solutions across the full spectrum of traditional and alternative risks transfer solutions.

- Specialty and wholesale business delivered with one global approach via hubs for large and complex risks.

- Playing the full market from national mid-sized companies to the largest multinationals with a comprehensive and dynamic range of solutions.

Our Allianz country CEO's will play a leading role in shaping Allianz Commercial in each of our individual markets. They will be working closely together with one leader per country or region representing one market facing team for Allianz Commercial.

In the UK, your Allianz Commercial management team contact is;

Commercial Managing Director for UK

Allianz Commercial

working with Barclays

At Allianz we recognise and understand the unique challenges you and your business face. And as a leading global corporate insurance carrier, we have the network and expertise to help. Find out why we’re best placed to help with insurance solutions.

.png)

We excel in underwriting

Our profound technical insurance expertise and industry knowledge allow us to provide you with solutions tailored to your needs.

In underwriting your risks, we stay true to our principles. It ensures we take those vital core competencies which you rely upon further.

The better we are at truly understanding complex risks, the better we can serve you. From harnessing insights from data, developing new forward-looking pricing tools or creating a harmonised global product framework, to practice groups leveraging shared expertise on specific risks or sectors, the goal is to provide market-leading solutions to you.

Underwriting response

Property

Limit of Liability

USD 750,000,000 in respect of Property Insured located in USA GBP 500,000,000 in respect of all other Property Insured per Occurrence all Sections combined

The above is split into Part A and Part B limits as described in the Schedule to Barclays Execution Services Limited All Risks Policy 2024-2025

Allianz Gross Fronted Line

Part A – 100%

Part B – 100%

Allianz Net Retained Line

Part A – 0%*

Part B – 35%

* Part A will be reinsured to Barclays Execution Services Limited. Allianz will not require collateral from the captive to guarantee this reinsurance

100% Gross Annual Premium

GBP 2,500,000 excluding:

- Local and central taxes and parafiscal charges;

- Additional charges for government / state pools and schemes;

- Any other local surcharges

- Captive fronting charge*

- AGCS SE Risk Consulting charge (to be agreed)*

Terrorism / Pools

Pool Re – to be confirmed

TRIA – USD 750,000

Captive Fronting Charge

GBP 15,000*

Brokerage

None

Long Term Agreement

Either

a) Three year agreement as per wording provided; or

b) Basel II agreement clauses as detailed in Barclays Execution Services Limited All Risks Policy 2024-2025

(both are subject to further information on recent claims – see below on Malicious Damage, Strikes, Riots, Civil Commotion coverage)

Coverage / Wording

As per Barclays Execution Services Limited All Risks Policy 2024-2025 except for the following:

- Accidental Failure of the Public Supply – we can provide a standard Public Utilities extension to the £50,000,000 limit requested but we will need to sub limit the ‘accidental failure’ coverage to £10,000,000.

- Malicious Damage, Strikes, Riots, Civil Commotion – we are likely to need an increased deductible for these perils. We will also need the 15 miles radius provision to be reinstated to the 168 hours clause. Final terms and conditions in respect of these perils will be subject to further information on settlement and quantum of recent claims and steps taken to reduce likelihood of recurrence. We will also define the perils.

- We will need to add ‘Nationalization, Confiscation, Expropriation (including Selective Discrimination and Forced Abandonment), Deprivation, Requisition’ to General Exclusion 5.1 War

- We will need to add an exclusion of Asbestos to General Exclusions 5.10 (c)

- We will need to remove the affirmative cover for terrorism from Extension 3.3.2 Denial of Access (Non-Damage) clause b) so it will read “occupation of the Premises by persons thought to be terrorists”. We can write back the terrorism coverage but this is Pool Re Class B coverage and will require offer and acceptance accordingly.

Subjectivities

- These terms are an indication only subject to internal approval from AGCS board for the credit risk associated with the fronting arrangement.

- 100% AGCS SE Fronted Solution subject to the following:

- Acceptable reinsurance capacity to be confirmed prior to inception. Reinsurers subject to approval by AGCS SE.

Allianz Risk Consulting

- Survey programme to be agreed

- Annual risk consulting charge to be agreed*

* All additional charges subject to UK IPT

Casualty

Limits of Indemnity

Policy

Limit

UK Employers’ Liability Limit:

GBP 10,000,000 any one occurrence

Public Liability Limit:

GBP 10,000,000 any one occurrence

Products Liability Limit:

GBP 10,000,000 any one occurrence and in the annual aggregate

Pollution Liability Limit:

GBP 10,000,000 any one occurrence and in the annual aggregate

Products financial Loss Limit:

GBP 5,000,000 any one occurrence and in the annual aggregate

Excesses

See below re captive retention

Premium

Total Premium:

GBP 404,000

+ Taxes (as appropriate)

Split as follows:

tba

Public, Products and Pollution Liability

GBP

Employers’ Liability

GBP

Programme Wording

The Master Policy Wording will be based on the wording included with the submission but with amendments to be agreed following a detailed review by Allianz Commercial.

The following changes will be required,

- A full review of the cyber exclusion and in particular the deletion of the final sentence.

- The sanctions condition to follow LMA3100.

- There may be other changes required following the review.

In addition, sub limits and aggregate limits for extensions and amendments to specific underlying amounts may be required. Areas where changes may be required include retrospective employers’ liability where we expect an aggregate to apply, legal defence cost extensions where inner limits should apply and excess auto coverage (especially in the USA) where underlying amounts will need a review.

Other alterations may be required.

Captive

The first GBP 250,000 of each occurrence/ claim will be reinsured by Allianz to Barclays captive (limited to GBP350,000 for all claims resulting from an occurrence impacting both EL and PL). The maximum amount reinsured, in any one period of insurance, will not exceed GBP 3,500,000. A cross class retention is under consideration by Allianz and if this does not go forward the aggregate of GBP 3,500,000 can be reviewed.

Allianz will not require collateral from the captive to guarantee this reinsurance.

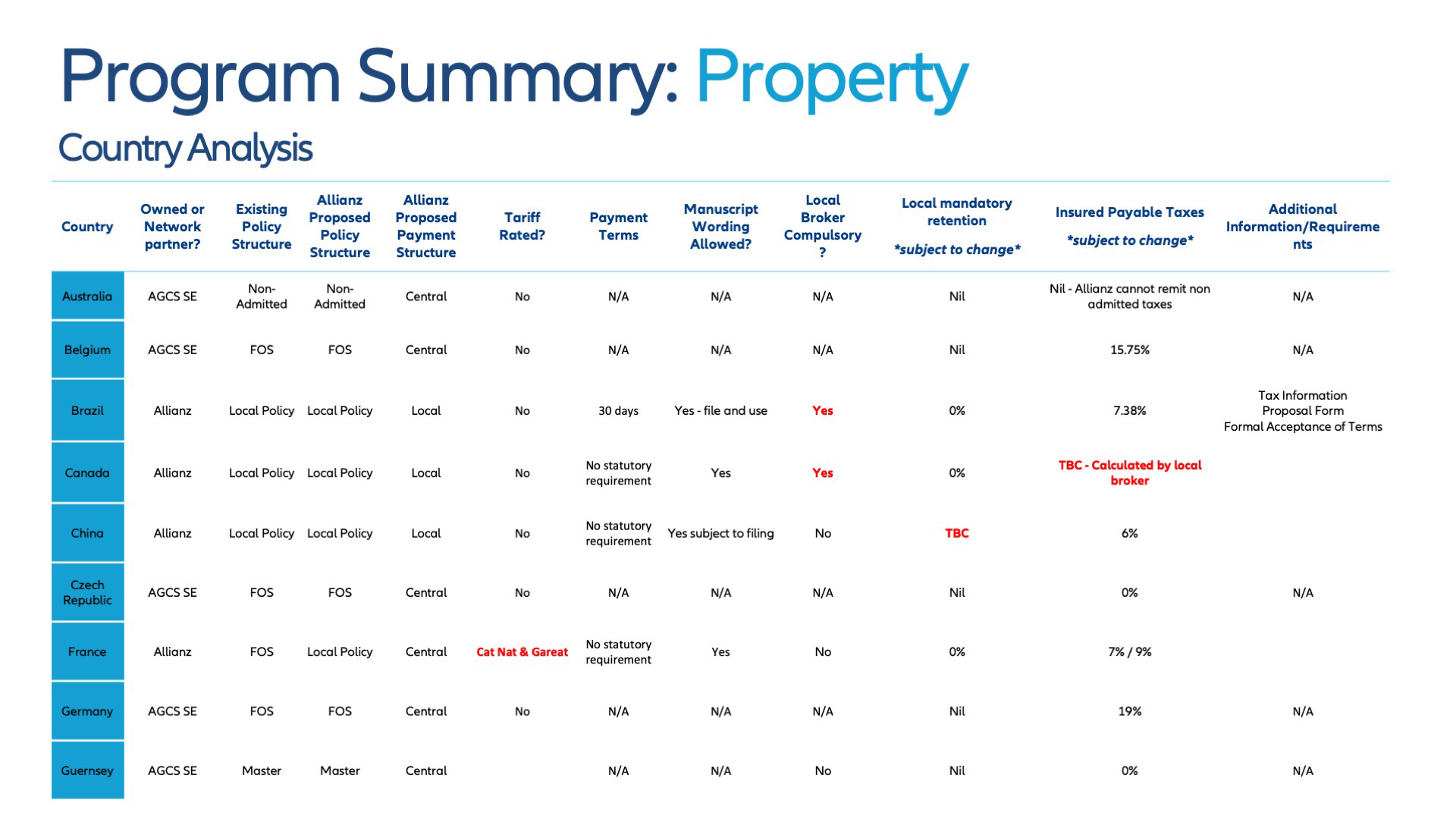

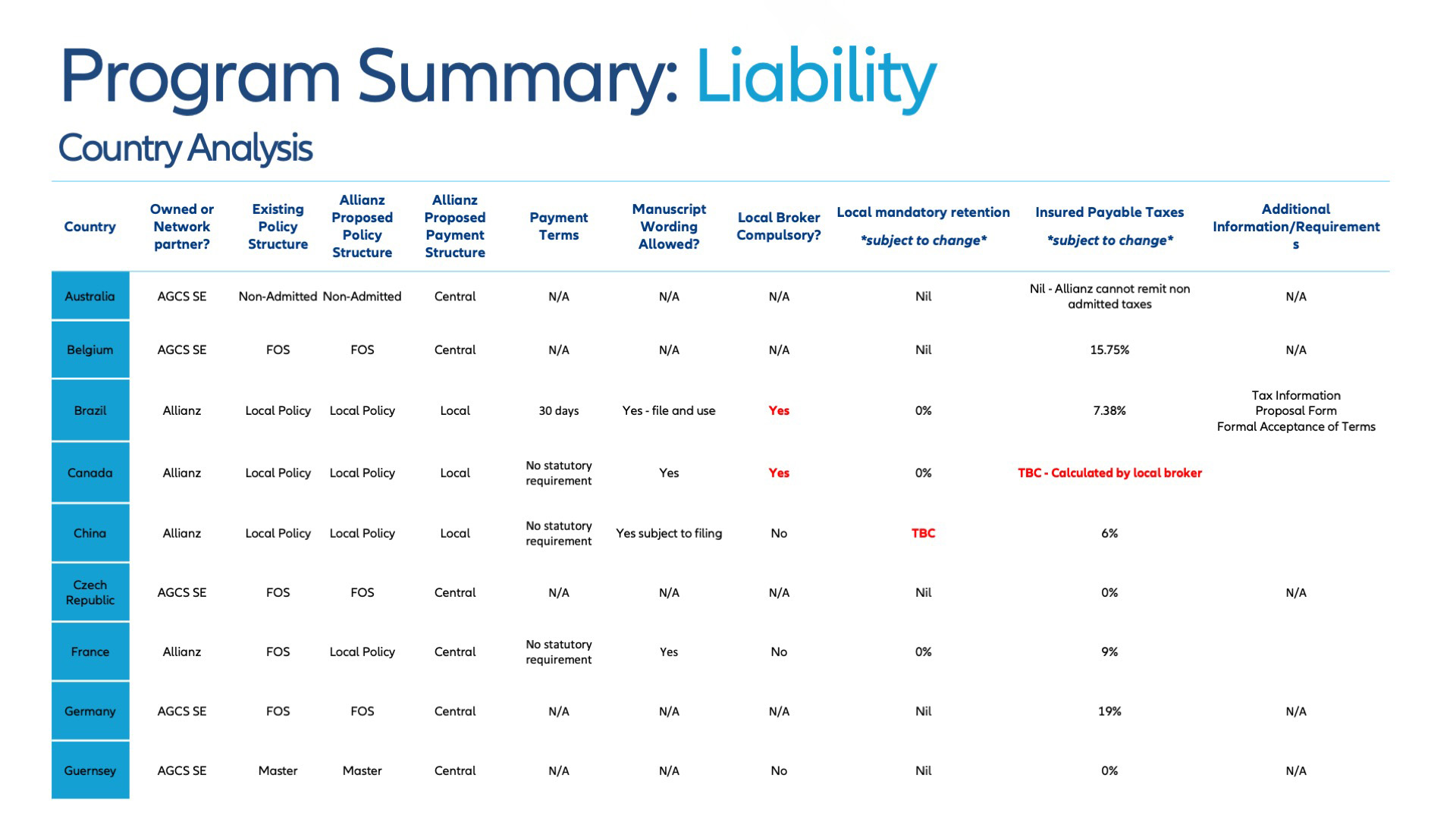

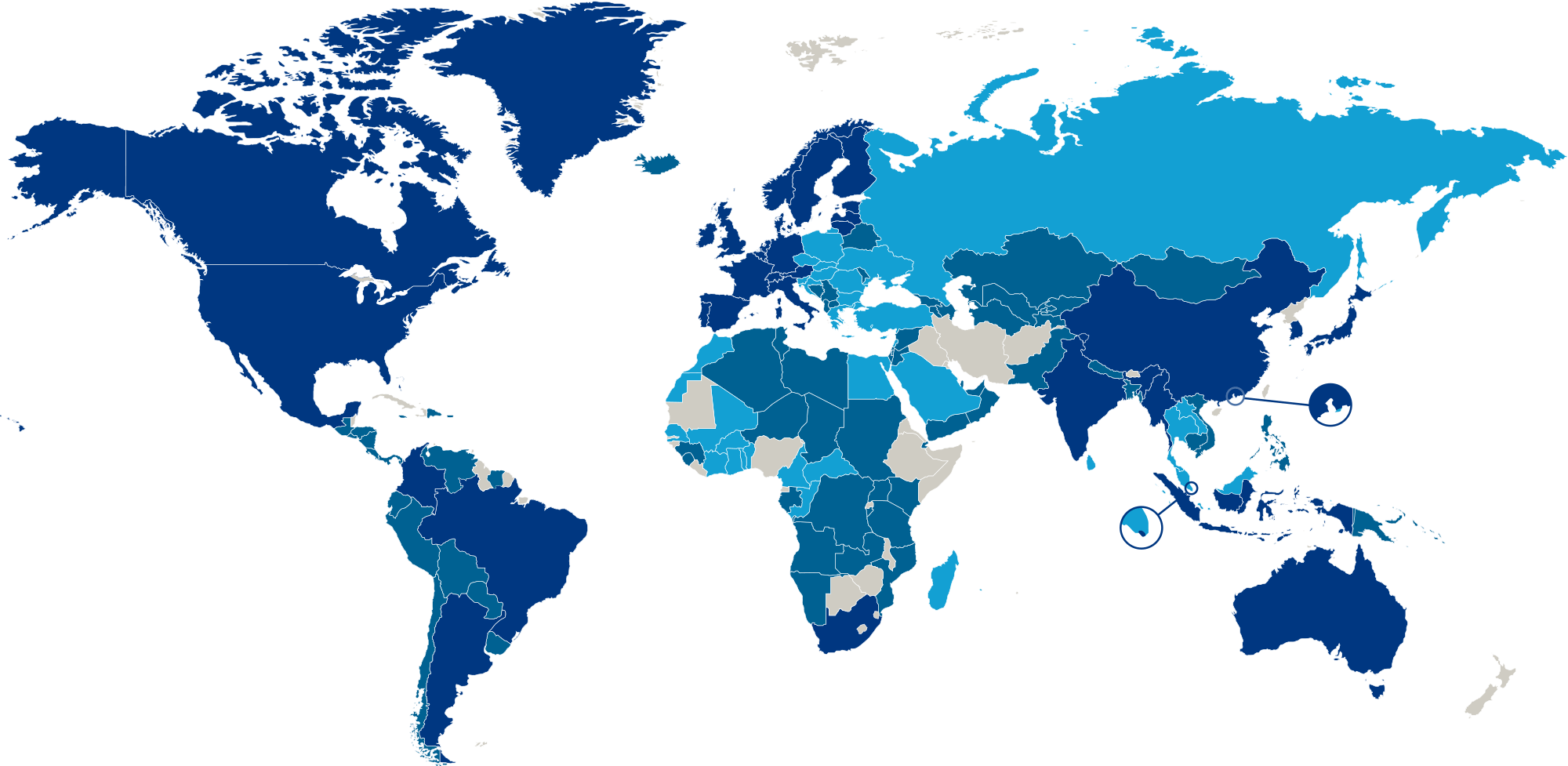

Multinational Programme

Local policies will be issued in territories as requested in the submission, on the basis of good local standard. Specific changes to local policies can be discussed based on local practice.

It is not possible for Allianz to issue local policies mirroring master policy wording.

We may need to issue a small number of additional local policies in territories following our review of where we can provide cover on a non-admitted basis.

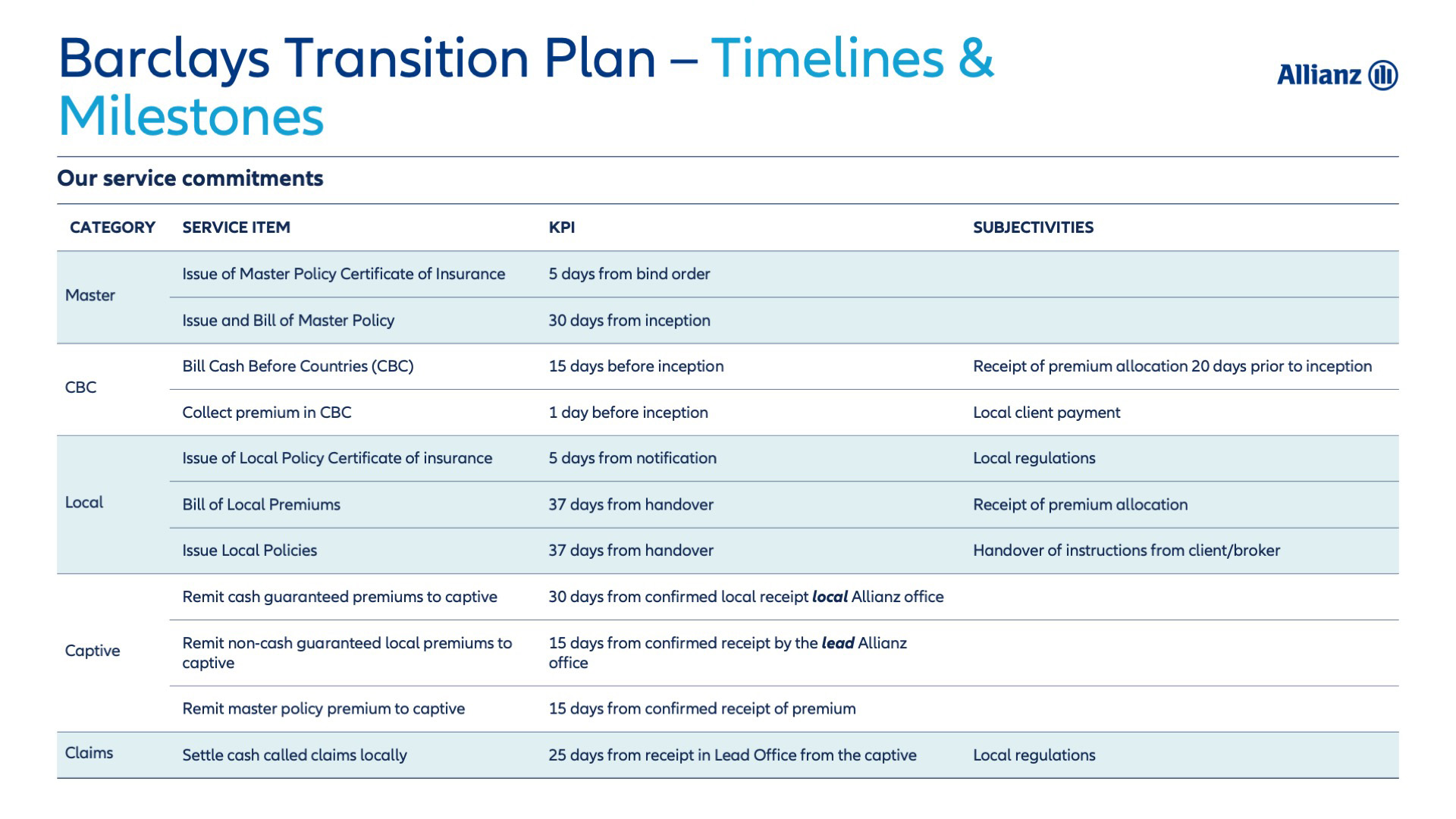

Allianz Multinational

Wherever you operate globally, Allianz Multinational is there to protect your business and secure your future. We’ve been supporting the business initiatives of our global clients since 1893, and are really proud of partnerships that we’ve built over the last 130 years.

Providing risk solutions, expertise and advice tailored specifically to your needs, we are there to help you and your teams navigate the complex risks that impact your business, wherever you are in the world.

Digital solutions providing transparency to support management of programs globally.

Allianz Network: 97% of the territories included in the Barclays Property & Liability program will be serviced by an Allianz office.

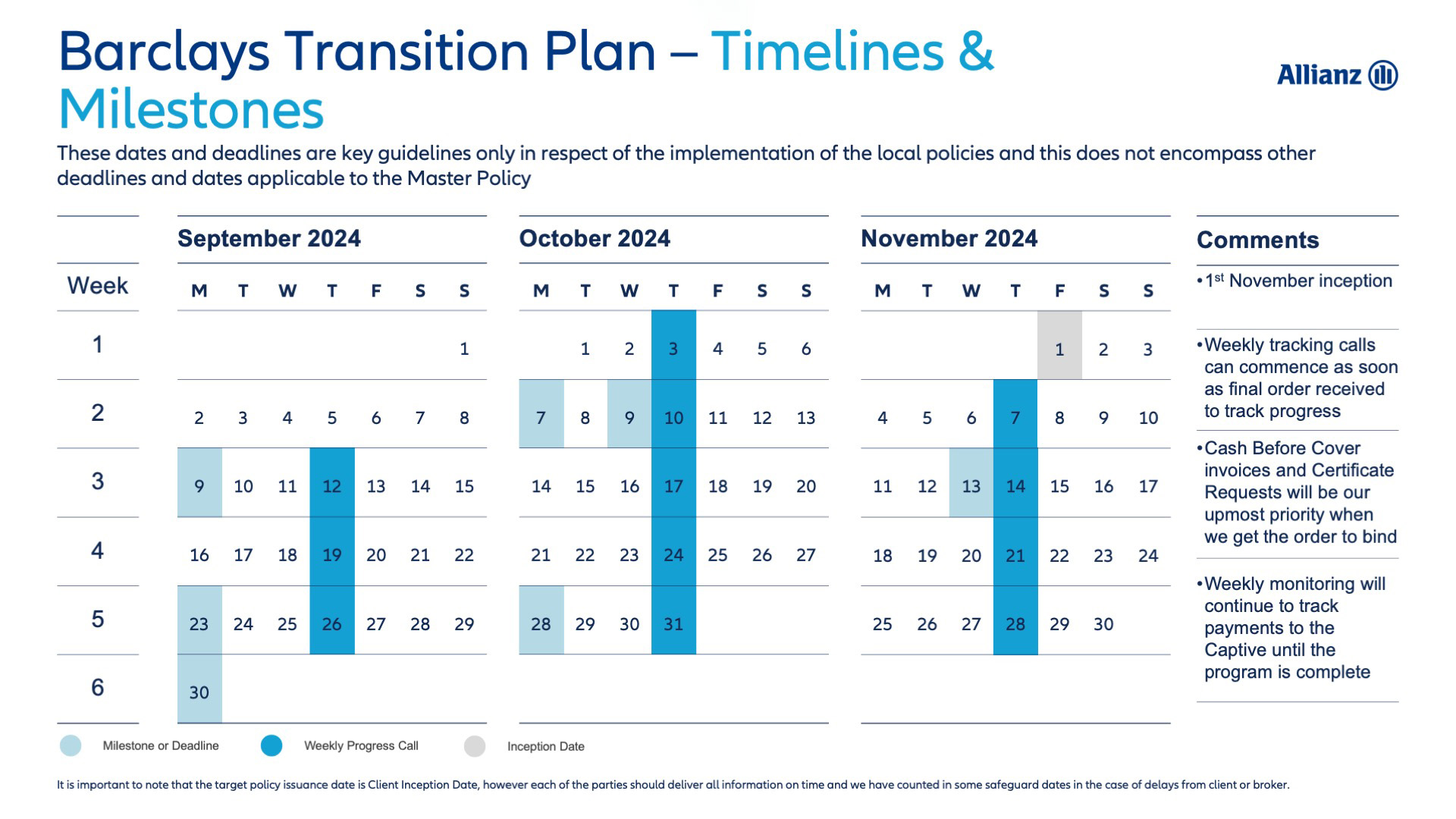

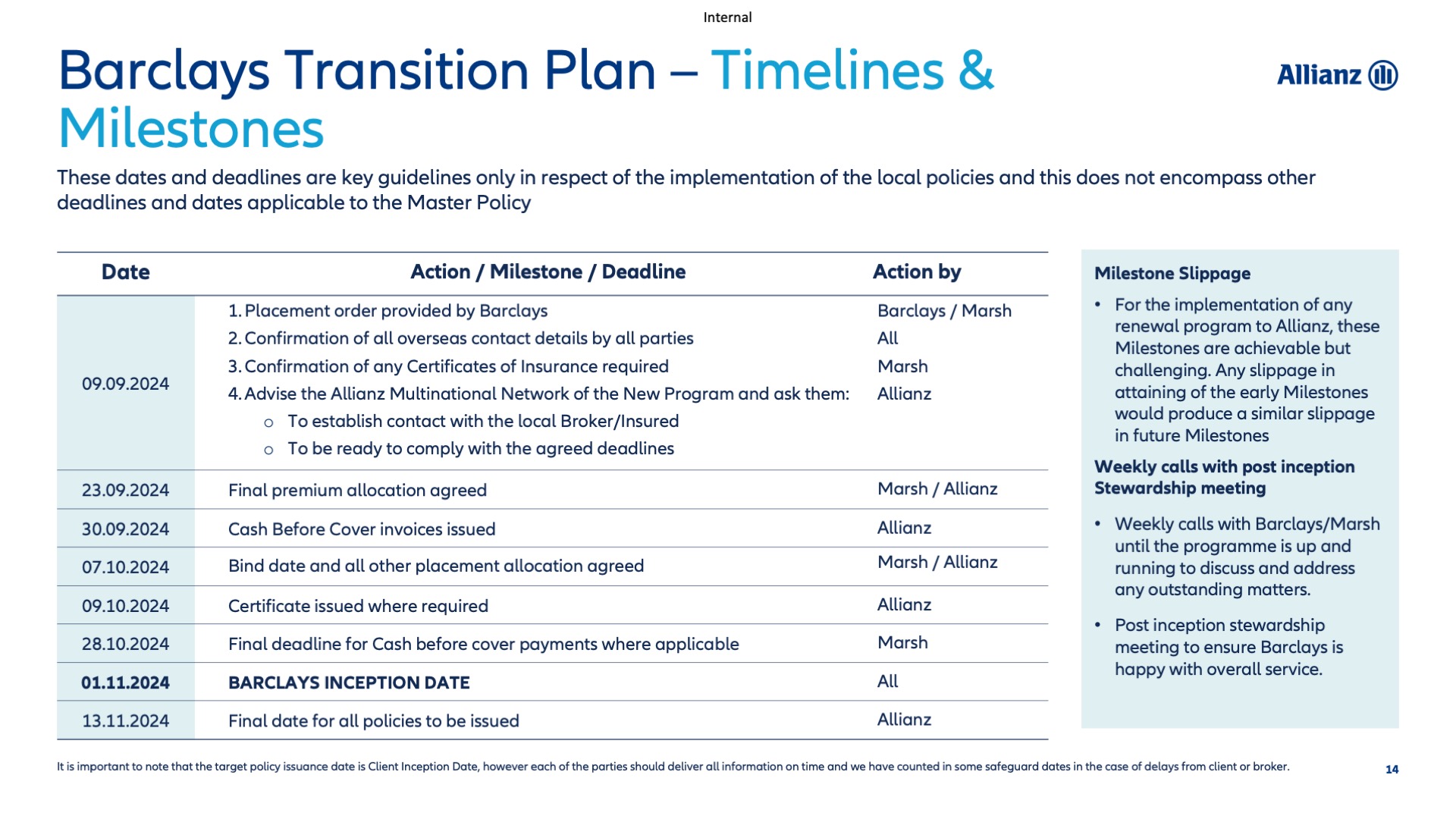

Unrivalled SLA’s: Whilst our standard KPI may be 30 days, we are consistently achieving an average policy issuance of 22 days in 75% of cases, demonstrating our exceptional performance

Captive Funding: Allianz will fund 100% of payments to Barclays’ Captive upon receipt of payment by any of our Allianz entities, further enhancing the advantages of our market leading owned network!

Dedicated Team: When partnering with Allianz, Barclays will benefit from having a dedicated Multinational Program Manager and an additional Multinational Program Coordinator for daily support, and designated Network Practice Leader and Team Manager as escalation points for addressing critical issues

My Allianz Commercial (MAC) Portal: Live access to your Multinational program data, policy documents, claims information including the ability to generate your own loss runs, and risk engineering information such as copies of surveys and risk recommendations

Network Management: Our Multinational Program Coordinators maintain direct communication with our entire network, eliminating the ‘middle man’ and preventing unnecessary delays

Network Partner onboarding: Not only Allianz partners can benefit from our in-house orchestration tool, as we are integrating all of our Network Partners, further enhancing efficiencies in policy issuance and data quality, directly contributing to the MAC portal

Monitoring Performance: Our Network Practice Leaders not only oversee and supervise the performance of our Network Partners but also hold responsibility for Allianz-owned offices.

Multinational overview

Allianz Risk Consulting

- Experienced engineers… from a wide range of technical and scientific disciplines.

- Client benchmarking… based on key loss insights and trends cultivated from rich data.

- A global network… of 250+ experts spread across 24 locations worldwide.

- Niche, specialist, expert contractors…capable of providing world-leading services and support.

- Access to market-leading insurance solutions…which make us the insurer of choice for many Global

500 companies. - Dedicated local point of contacts… who work with you throughout your policy lifecycle.

- Competitive pricing and conditions… with comprehensive, accurate, data-driven insights.

Allianz Risk Consulting Property offers our clients comprehensive risk engineering and the key services include:

- Site surveys for property, business interruption and construction

- Reviews of loss control management programs

- Business Interruption analysis

- Business Continuity Management

- Technical training and knowledge transfer

- Plan & project reviews

- Testing & commissioning of fire protection systems

- Fire protection impairment management

- Loss investigation surveys

Specialist Risk Resources and Services

The Account Engineer will explain, guide and advise on which specialist resources will compliment and add value to your existing loss prevention programme. We recognise that one size will not fit all and our goal is to work in partnership with you to maximise the improvement and impact on your risk profile of our tailored risk solutions to support your business objectives.

Examples of risk management tools available include:

- Using the My Allianz Commercial, our clients can, amongst other things, access information regarding their loss control programmes in real time, download reports, update recommendations & notify us of impairments to fire systems

- Allianz AlertZ will automatically send out risk information and newsletters featuring risk bulletins, technical documents, lessons learned and other risk advice and publications

- Cyber risk has proven to be of increasing concern to our client’s and whilst hacking of IT for data and finance grab the headlines, there are exposures to IT systems running production equipment. ARC has employed a Cyber Risk Consultant to assist clients who may have concerns in this area

- Whilst the Account Engineering function will offer an overview of the business interruption potential at account level, and the effects on any linked locations, a more in depth study can be undertaken looking at the policies and procedures in place for Supply Chain Risk Management applying technics such as the European Foundation for Quality Management

- ARCFlex a more focussed client centric approach to risk consulting eliminating the need for repeat survey work

- The Allianz Property Risk Management Charter aids client’s to embed prudent Human Element practices and procedures throughout their organisation

Claims

Understanding Your Needs

At Allianz Commercial, our Claims philosophy is solution-oriented.

We’re committed to finding preferred solutions with big picture thinking in respect of large and complex policies, building trusting relationships with you based on continuity of experience:

- We value an honest dialogue

- Transparency of communication

- Consistency, speed and ease of service delivery

Capabilities

As an international lead insurer, our 600+ Claims handlers and Global Practice Groups offering specific industry & Claims expertise are there to drive preferable outcomes for our customers.

- 600+ Allianz Commercial Claims handlers over 30 countries and network partnerships in other locations allow us to service clients in more than 200 countries and territories

- 6 regional teams ensure proximity and local expertise

- 16 Global Practice Groups offering specific industry and Claims knowledge

Attitude

Our Claims philosophy is solution-oriented: we value an honest dialogue.

We work tirelessly to provide clarity and eliminate ambiguity, prioritizing a ‘no surprises’ culture.

- We’re committed to finding preferred solutions with big picture thinking in respect of large and complex policies, building trusting relationships with you based on continuity of experience

- 0.3% and 1.7%* of cases in litigation 1st vs 3rd party

Settlement Experience

Our Claims settlement process is based on upfront and regular communication.

We explain our Claims process, timelines, and requirements upfront – to give you peace of mind at every stage of your Claims journey.

- In our annual net promoter score survey, clients and brokers who have had an experience with Claims 3 times more likely to recommend Allianz Commercial

- We offer upfront payments for 1st party Claims

Value-adding Services for Key Clients

We discuss and implement client-specific Claims Protocols and dedicate experienced Claims experts to ensure we meet your business needs.

In 3rd party Claims we understand your unique requirements and support you over the long term.

- We offer a digital interaction via our customer portal displaying time-accurate and meaningful Claims information

- Claims insights and trend updates

Alternative Risk Transfer

Integrated / Structured Solutions

Customized solutions provided on a multiyear, multi-line basis designed to complement or replace a client’s existing monoline program. Flexible integrated capacity can be utilized at different attachment points depending on client needs and locks in rates over the program term. Can range from being risk transfer to risk financing motivated, or a blend thereof.

We also provide direct Virtual Captive solutions that offer many benefits of a captive for clients that do not have one.

Fronting Solutions

Providing access to Allianz’s vast network of insurance carriers and partners, these solutions involve multi-year commitments and utilize proprietary techniques to minimize collateral requirements and reduce costs to clients.

Structured Captive Reinsurance

Providing flexible, structured reinsurance solutions to captives, again on a multiyear, multi-line basis to provide stability over time, while retaining the flexibility to deal with changing situations. These can be offered together with or independently of captive fronting programs.

Special and Difficult to Insure Risks

ART are able to provide insurance or captive reinsurance solutions for special or difficult to insure risks outside of the traditional Allianz Commercial lines and appetite as long as they can be underwritten, or risk financed.

Capabilities

- Global Fronting capability expands across 200+ countries and on a multi-line and multi-year basis, if needed.

- Capacity typically €25mn per occurrence per annum but can be higher depending on structure.

- Broad range of P&C lines of business or a combination thereof.

- Can include traditional and non-traditional elements, including parametric triggers.

- Transactions up to 5 years tenure, with ability to extend.

- Typical minimum premium (after profit commission) EUR250,000 p.a.

- Risk Financing structures work best where traditional ROL > [10%].

Environmental, Social and Governance (ESG)

Our progress and commitments

We're committed to being transparent so that our customers and stakeholders can trust our company and our investors to be confident about how we manage their money. Full details of our commitments and performance are set in our 2022 Sustainability Report.

commitment to reach net-zero greenhouse gas emissions in our proprietary investments and P&C insurance business by 2050*

renewable electricity of own operations

sustainable investment (proprietary investments)

Proud partner and signatory to alliances and partnerships

We believe in the power of collaboration and view long-term partnerships as instrumental to delivering positive change. Allianz’s businesses are signatory and member to a wide range of global sustainability initiatives and principles such as the below.

*As the specific definition of Net-Zero is still evolving for financial institutions and we anticipate CSRD requirements, we are no longer referring to the 2030 target for our Own Operations as a Net-Zero commitment. We will instead refer to it as a 2030 intermediate target. The rest of the decarbonisation and removal targets for Own Operations remain as communicated in the Inaugural Net-Zero Transition Plan

Net-zero Plan

- For P&C commercial insurance, we have now announced tangible interim targets for 2030 to reduce the GHG emissions associated with our portfolio (which includes various part of the business, including Allianz Commercial, Allianz Trade, and others.)

- Allianz Group’s interim plan now aims to reduce the emissions intensity of this portfolio by 45% by 2030. Emissions intensity shows the number of client-generated emissions associated with every 1 million euros of premium and allows for dynamic measurement of emission reduction in line with a growing portfolio.

As announced in 2021, the gradual phase-out of coal-based business models by 2040 will be continued.

Supplemented by the adjusted underwriting approach for oil and gas companies introduced in April 2022.

Expansion of renewable energy and low-carbon technology insurance as part of the overall Allianz Commercial portfolio.

We are committed to profitably growing revenues in Property Damage (PD) and Business Interruption (BI) coverages related to these transition solutions by 150% by 2030 compared with 2022.